Despite the celebratory tone of the Sifted 100 UK & Ireland Leaderboard 2025, one glaring reality stands out: climate tech startups are not scaling at the pace or presence needed to match the urgency of the climate crisis.

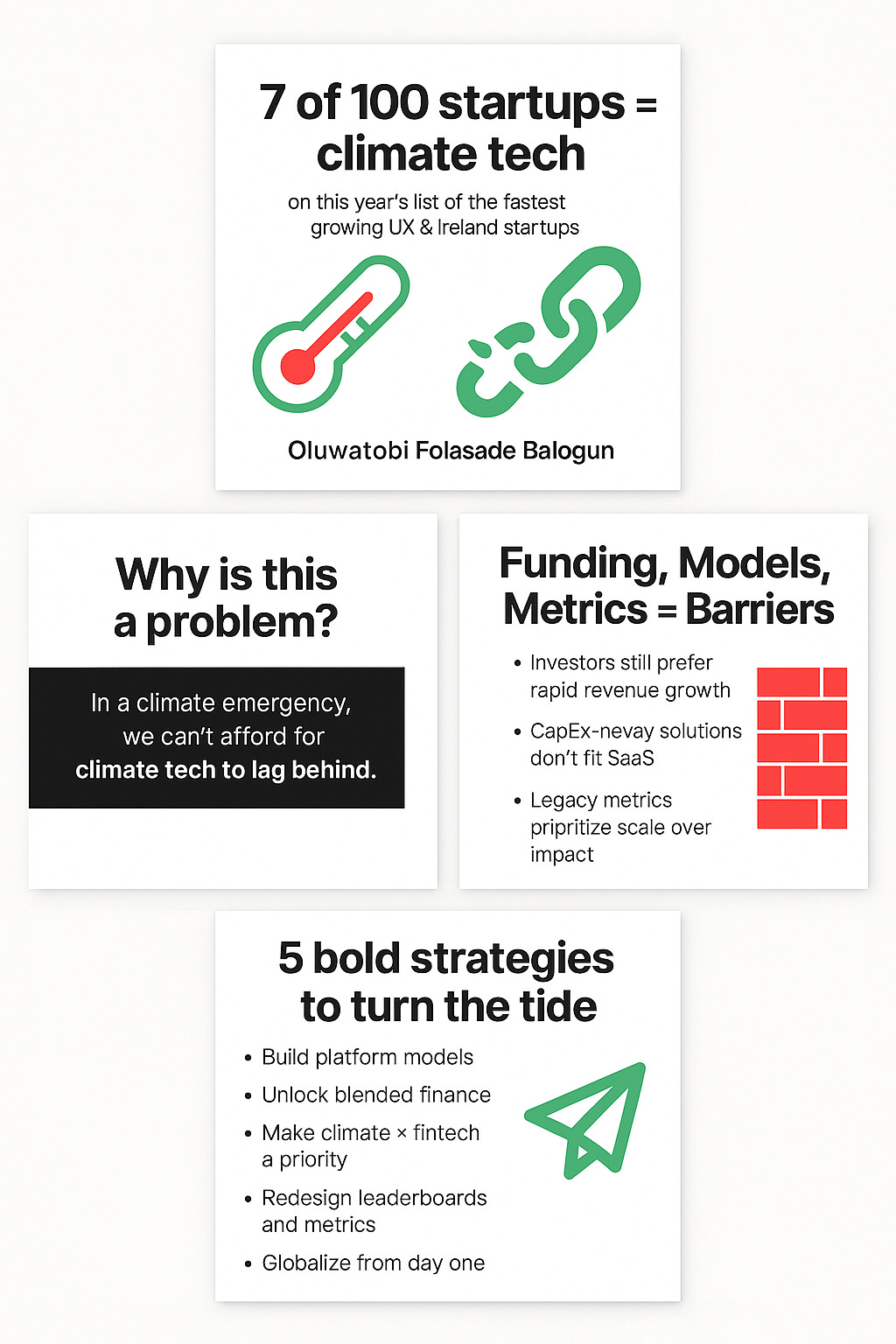

Only seven of the 100 fastest-growing startups fall under the "climate" category, a marginal improvement from four in 2024. In contrast, fintech dominates with 40 companies, followed by B2B SaaS and healthtech. These numbers speak volumes.

What’s Holding Climate Tech Back?

Capital Allocation Misalignment: Investors still favour sectors with rapid ARR growth and clear SaaS models. Climate tech, often CapEx-intensive and regulatory-tethered, doesn’t fit neatly into the high-velocity VC playbook. Even promising names like Switchee (social housing energy management) and Sunsave (solar subscriptions) don’t yet report profitability.

Overreliance on Public Funding: Innovate UK is the most prolific public investor on the list. But where are the equivalent private backers scaling climate tech beyond pilot phases?

Underrepresentation in Top-Tier Rankings: None of the climate startups crack the top two-year CAGR (Compound Annual Growth Rate) figures set by fintechs or legaltechs. This is not necessarily due to a lack of innovation, but rather a lack of strategic scaling support.

What Can Be Done? Strategies to Catalyse Growth in Climate Tech Startups

1. Shift from Pilot to Platform

Climate solutions often get stuck at the pilot stage. Startups must design for scalability early adopting modular platforms, SaaS-style business models (where possible), or embedded data intelligence that enables recurring revenue (e.g. carbon intelligence-as-a-service).

2. Drive Blended Financing Models

Climate tech founders need more than traditional VC. Catalytic capital from development banks, corporate partnerships, or outcomes-based financing can bridge the viability gap especially for infrastructure-heavy solutions.

3. Build the Fintech–Climate Nexus

Some of the most scalable climate solutions may emerge at the intersection of climate and fintech: think carbon accounting integrations in SME banking, insurance products that reward sustainability benchmarks, or climate-risk-adjusted lending.

4. Highlight Mission-Aligned Growth Metrics

We must move beyond CAGR (Compound Annual Growth Rate) obsession. A leaderboard that values carbon saved per £ of revenue, climate equity impacts, or emissions avoided could reshape the narrative and funding priorities.

5. Localise for Global Impact

Many UK-based climate tech firms are still focused on local or EU markets. However, with the Global South bearing the brunt of climate change, exporting technology, partnering with governments, or piloting initiatives in high-need areas like sub-Saharan Africa or South Asia could unlock both impact and growth.

The Takeaway

Startups are not just about scale, they’re about solving problems that matter. And climate tech, arguably, tackles the biggest problem of our generation.

If we want to look back in 2030 and say the UK & Ireland were climate tech leaders, not laggards, then founders, funders, and ecosystem builders must do more, now.

🟢 Climate tech doesn’t need to catch up. It needs to break out.

Let’s continue the conversation. What other structural shifts do we need to fast-track climate innovation across the UK and beyond?

#ClimateTech #Sustainability #StartupLeadership #ESG #InnovationStrategy #UKTech #Sifted100 #ImpactInvesting #GreenGrowth